THEN CHECK OUT HOW MUMBAI WOMAN GETS TRICKED TO LOSE 7LAKH AFTER ACTIVATION OF A CREDIT CARD

- A woman from Panvel, Mumbai recently fell victim to an online scammer. The 40-year-old woman received a call from a person named Saurabh Sharma who impersonated himself to be a bank employee and offered her a new credit card with complimentary membership to a sports club in the city and a free Android phone.

- She shared her personal details, including her Aadhaar card with the fraudster. The scammer then said that the credit card could only be activated with an Android smartphone, as the woman was using an iPhone. He asked her to replace her device with the new phone which he was sending, and she agreed, providing her home address for delivery.

- The woman received the Android phone with two pre-installed apps, DOT Secure, and Secure Envoy Authenticator. Sharma asked her to insert her SIM card and follow the instructions to activate the credit card. Afterward, she received two messages about bank transactions notifying her of an unauthorized purchase of 7 lakhs from a jewelry shop in Bangalore.

REPORTING FRAUD

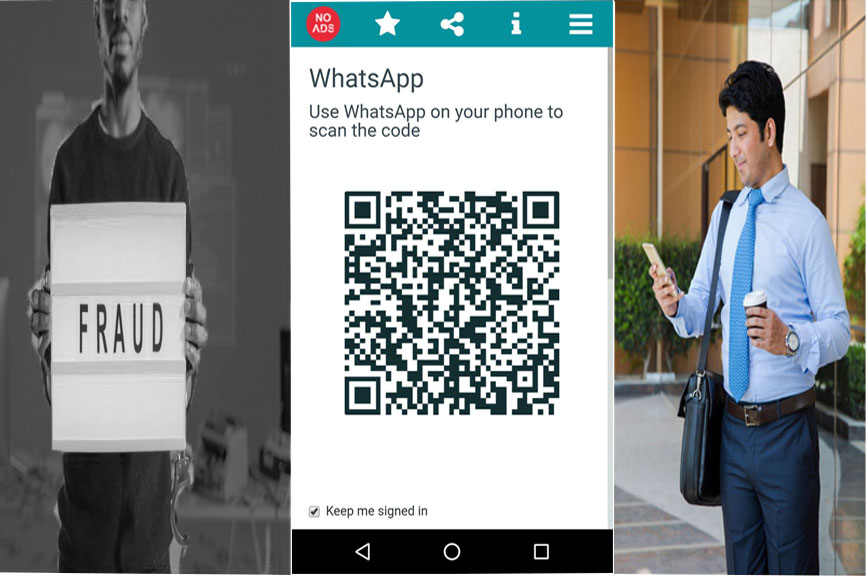

Realising she had been scammed, the woman reported the case of fraud to the Khandeshwar police the next day. This case raises questions about how the scammer was able to trick the woman with a newly issued credit card. Was it a case of phishing? Or a fake credit card.

ANALYSING THE FRAUD

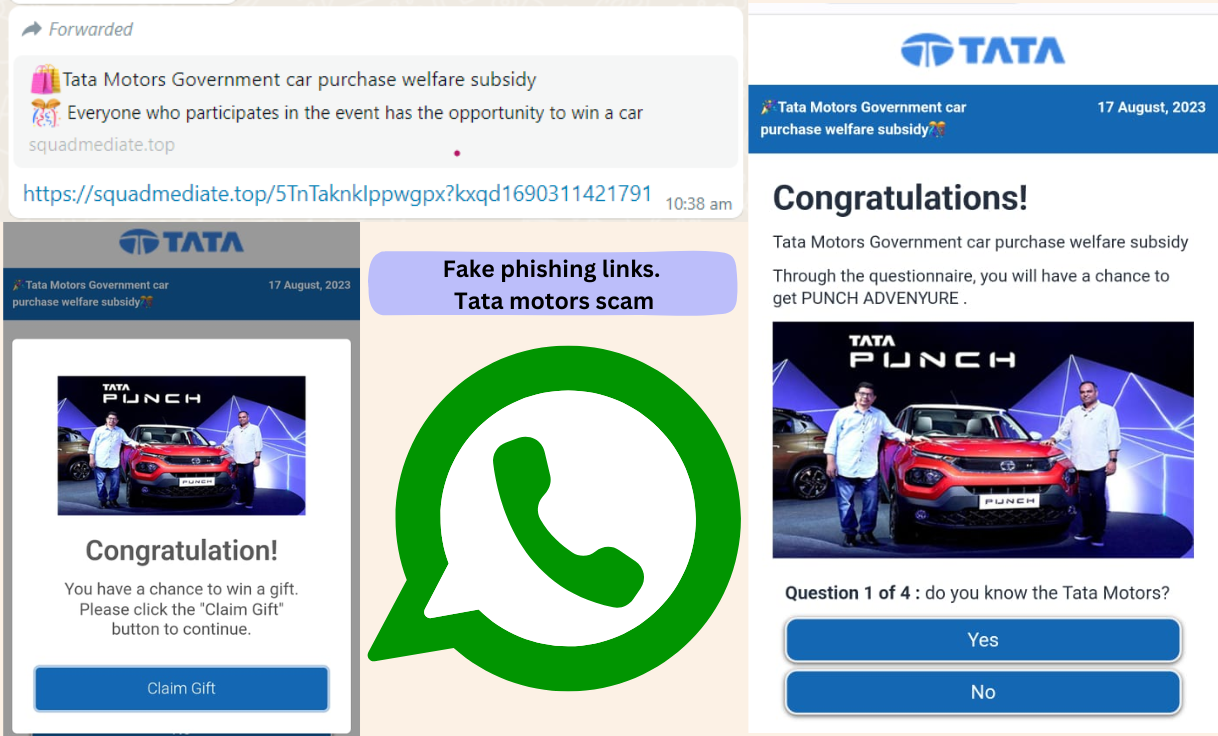

- This case appears to be a case of phishing at first glance. The scammer acquired all the woman’s details and used her credit card to make a purchase. However, a closer look reveals there is a layer of tricks employed by the fraudster.

- To start, the scammer called the woman and proposed a free membership to a distinguished club if she accepted a credit card. She was taken in by the offer and revealed her personal information, including her Aadhaar and bank details. The scammer then applied for the credit card in her name.

- Afterwards, the scammer tricked the woman into using an Android phone with two preinstalled apps to activate the credit card and obtain its pin and other details. These apps can be used to access the victim’s bank account or credit card information. Once the credit card was activated, the scammer used the details to complete the transaction.

- It is worth noting that a credit card can be used without a physical card by adding its information to UPI or net banking. The scammer took advantage of this.