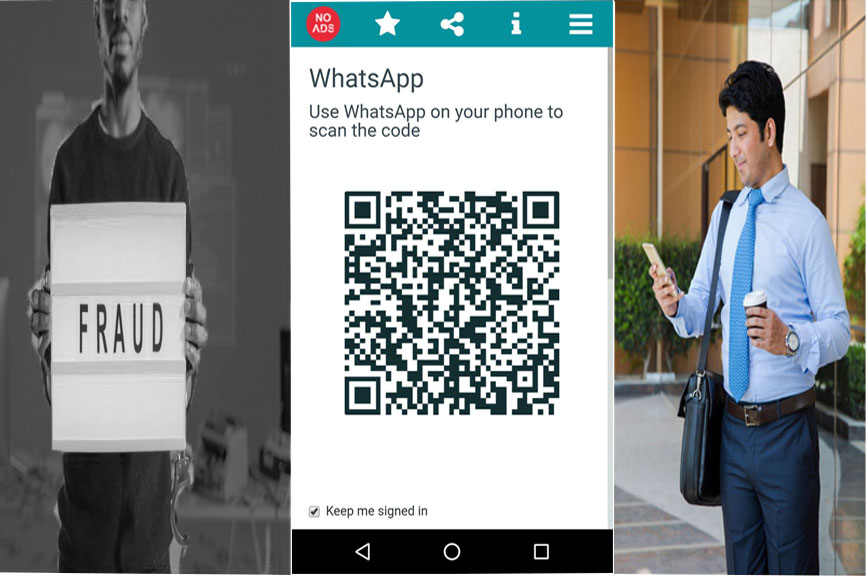

A 65-year-old businessman in Mumbai lost almost Rs 40 lakh from his bank account due to cyber fraudsters who had his phone’s SIM card blocked and a new one issued by the mobile service provider. By obtaining the new SIM card, the fraudsters were able to receive one-time passwords and other alerts necessary for carrying out fraudulent transactions, according to the cyber police.

An FIR was registered by a businessman in the complaint he was targeted by cyber fraudsters who exploited his phone’s SIM card to gain unauthorized access to his bank account. With his SIM card blocked and a new one issued, the fraudsters were able to intercept important notifications including one-time passwords (OTPs) and alerts required for their fraudulent transactions. He was unable to make any calls or receive messages, even on WhatsApp.

The cyber police have contacted the bank’s nodal officer and discovered that Rs 39.5 lakh was transferred to different accounts in eight separate transactions. It was determined that the funds were then withdrawn from ATMs in West Bengal that same morning. As a result, the police have requested the freezing of the seven accounts where the money was transferred. Additionally, letters have been sent to the respective banks informing them of the situation.

The police discovered that the criminals had emailed the mobile service provider, including the number on the card, asking for a SIM change. The complainant’s SIM was suspected to become inactive once the accused received the new one. The officer stated, “We have contacted the company to request information regarding the SIM change. We are currently awaiting their reply.”

The accused, who has not been identified, have been charged with cheating and forgery under the Indian Penal Code and identity theft under the Information Technology Act. The investigation is being conducted by a Cyber team.

It is advisable to always have two-step verification for all bank accounts, set an upper withdrawal limit, change the net banking password if the sim is not functioning, and request the bank to halt all transactions.

It is advisable to always have two-step verification for all bank accounts, set an upper withdrawal limit, change the net banking password if the sim is not functioning, and request the bank to halt all transactions.