Unraveling the Olx Scam: Kejriwal’s Daughter Falls Victim to Rs 34,000 Fraud – Insights and Prevention Strategies

Delhi chief minister Arvind Kejriwal’s daughter was recently a victim of an online scam where she tried to sell an old sofa set on OLX but was dupped of Rs 34,000 by an online scammer.

Surprisingly, these types of scams have grown prevalent on e-commerce websites, exploiting users due to their limited understanding of online transactions. The online marketplace OLX has particularly suffered from these fraudulent activities, leading users across the nation to report instances of being swindled on the platform.

In the most recent incident, a complaint was lodged at the Civil Lines Police Station, which is in close proximity to the Chief Minister’s residence. The police have registered a case of fraud and have initiated efforts to locate the perpetrator.

Outcome of This Case:

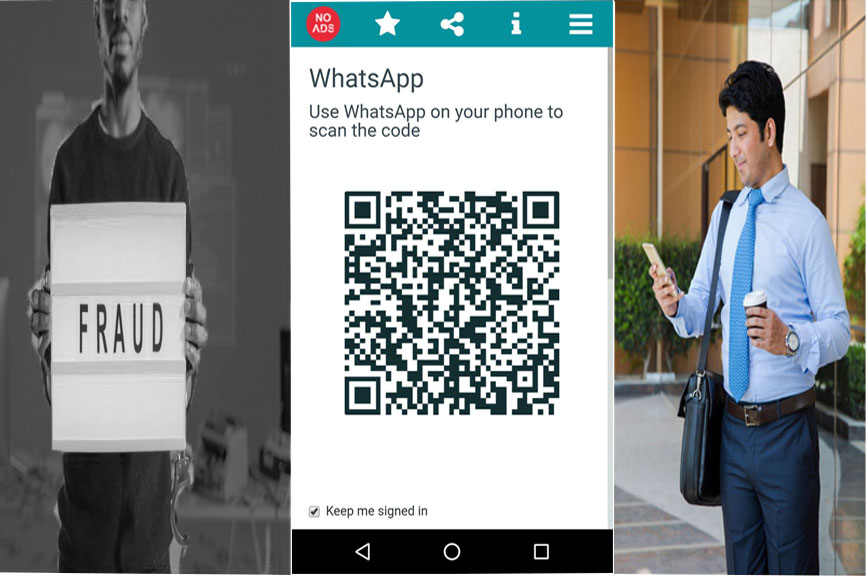

Harshita Kejriwal, who holds a chemical engineering degree from the Indian Institute of Technology (IIT-Delhi), endeavoured to vend a second-hand sofa through the well-known online marketplace OLX. A prospective buyer engaged with her on the platform, and after mutual agreement, they proceeded with the transaction. The swindler provided Harshita with a QR code, urging her to scan it to facilitate the fund transfer. As a gesture of credibility, a minor sum was initially deposited into her account. Subsequently, the perpetrator extracted Rs 34,000 from her account in two successive transactions—first Rs 20,000 and then Rs 14,000.

Mechanism of Operation for This Scam:

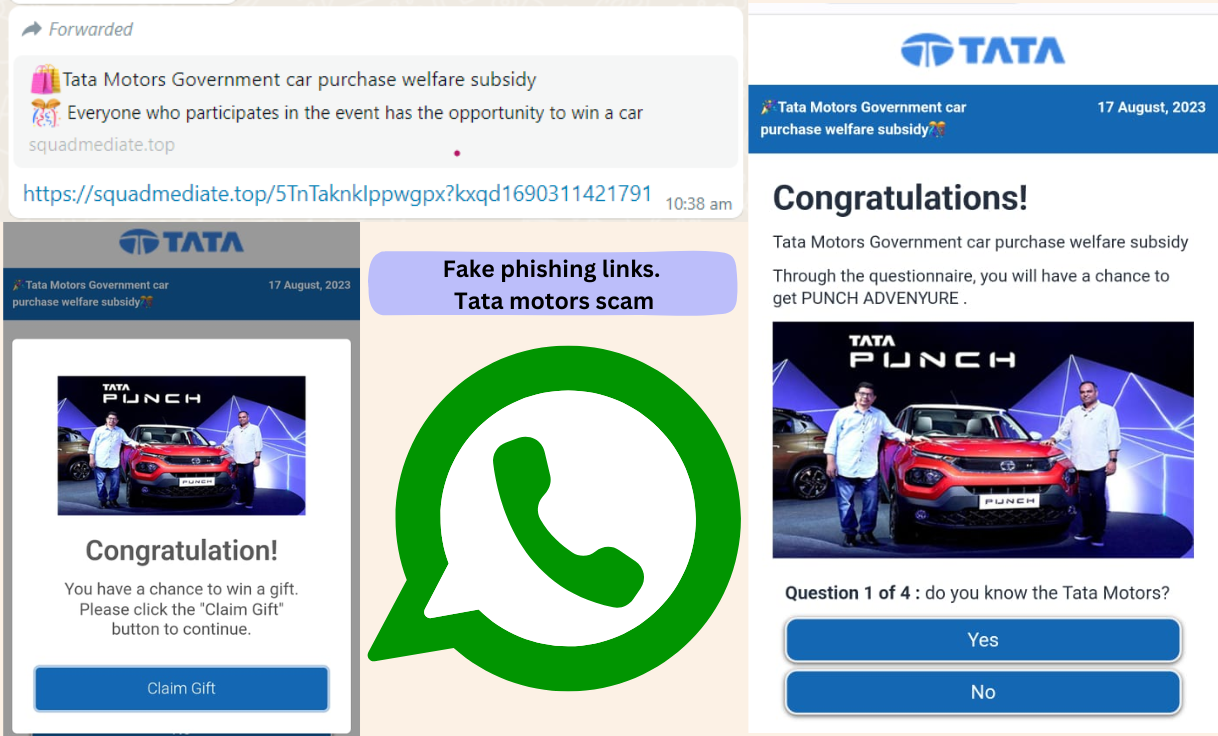

In this particular scheme, scammers leverage the Unified Payments Interface (UPI) once they establish the victim’s confidence, as seen in the case of Harshita Kejriwal. UPI has become a highly convenient method for money transfers, propelled by the growing usage of applications such as Google Pay, PhonePe, and similar platforms. While UPI offers simplicity, speed, and ease, perpetrators capitalize on users’ limited technical familiarity with the feature to orchestrate fraudulent activities.

The scammers employ two common tactics: they dispatch either a QR code or a payment acceptance request under the guise of purchasing the victim’s listed item. Occasionally, they introduce an unnecessary sense of urgency and express willingness to pay without inspecting the item, asserting their fear of losing out on the opportunity. In both scenarios, the objective remains the same—to deceive the user. The fraudster prompts the user to scan the QR code or approve the payment request, warning that failure to do so will result in a transaction failure.

Oftentimes, the victims, driven by either their limited awareness or the pressing need to sell their product, inadvertently overlook the fact that receiving payment necessitates no action on their part. Consequently, they succumb to the ploy. Once they scan the QR code or approve the request, the specified amount is immediately debited from their account. Following this, the fraudster vanishes without a trace.

Regrettably, OLX has transformed into a hunting ground for these swindlers, and numerous instances of such nature have been reported across various regions of the country.

Preventive Measures Against Such Fraud:

The users need to remain calm and composed while doing such deals on e-commerce platforms. They should assess everything before accepting any payment request. The basic thing to keep in mind is that all UPI apps ask users to enter their UPI PIN or M-PIN while making a payment, which differs for every linked bank account. This is not required to accept payments. So, if the app asks you to put this PIN after scanning the QR code, it should be the first flag. Do not enter the code and cancel the transaction. The same goes for the payment requests sent. They also seek the M-PIN from users before deducting the amount.

They begin by sending a nominal sum, often labeled as a ‘test payment,’ which swiftly reflects in the recipient’s account. Subsequently, they entice the victim with a QR code for a larger amount, invoking a Two-Factor Authentication (2FA) step that involves the UPI PIN. The mechanism is straightforward, yet vigilance remains crucial. What eludes many users is the fact that only debits necessitate authentication through methods like OTPs, passwords, MPINs, or UPI PINs, contingent on the chosen payment mode

Before endorsing any payment request on a platform, thoroughly peruse the accompanying message. Frequently, the message content should contain cues indicating potential fraud. If uncertainty lingers, don’t hesitate to decline the request.